The CIL Trick: When the Council Develops Homes and Quietly Misplaces Its Own Tax Bill

There’s a special kind of magic in Shropshire Council’s housebuilding operation.

The sort of magic in which houses appear, PR photos multiply, councillors beam…

and then — poof! — the Community Infrastructure Levy (CIL) vanishes like a toddler’s biscuit.

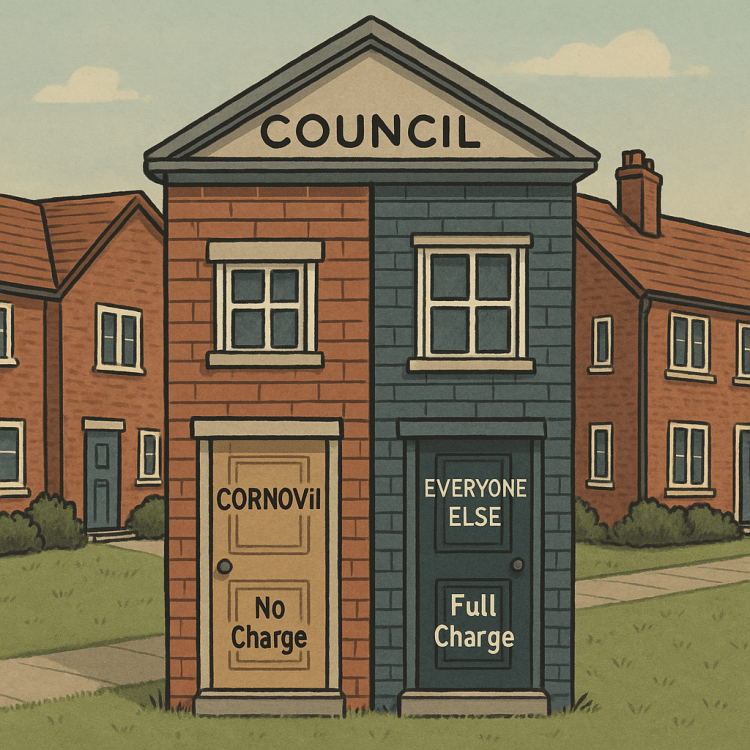

CIL is the boring, unavoidable tax every developer must pay on new homes.

Except, apparently, when the developer is Shropshire Council’s own housing company, Cornovii.

Because nothing says transparent local government quite like charging yourself

and then pretending the invoice slipped behind the filing cabinet.

THE FRITH: WHERE TRANSPARENCY WENT OUT FOR A PAPER AND NEVER CAME BACK

The Frith — 33 new homes in Crowmoor, built by Cornovii Developments Ltd.

The Council was eager to shout about apprenticeships, EPC ratings,

“building communities”, and Section 106 contributions.

But one thing never made the brochure: the CIL bill.

Based on floor area and indexed rates, The Frith should have generated

£130,000–£140,000 in CIL.

Odd, then, that the Council can itemise a £79,000 S106 payment

while the six-figure CIL levy quietly vanishes.

IFTON GREEN: A SECOND CASE OF NOW YOU SEE IT, NOW YOU DON’T

In St Martins, the story continues — 34 homes at Ifton Green. Again, the fanfare,

the self-congratulations, the ‘community benefit’ speeches.

But the CIL? The money that actually matters?

Silence.

Based on rural CIL rates, the development should have owed roughly: £280,000 in CIL.

Yet again: no notices, no receipts, no allocations, no answers.

And for avoidance of doubt, council-owned companies aren’t exempt from CIL — at least not anywhere in the actual law.

CIL vs S106 — EXPLAINED

Section 106 (S106)

A private deal between the council and developer. If your development causes problems, the developer pays to fix them.

Community Infrastructure Levy (CIL)

A tax per square metre on new homes. Almost impossible to avoid… unless you’re the Council’s own developer.

THE PATTERN

Across both schemes:

• S106 trumpeted.

• CIL quietly disappears.

• No notices published.

• No receipts disclosed.

Meanwhile the county’s CIL pot exceeds £37 million.

THE QUESTIONS

1. Did Cornovii pay full CIL on The Frith?

2. Did Cornovii pay full CIL on Ifton Green?

3. If not, why not?

4. If yes, where did it go?

FOIs have now been submitted. Answers will come, eventually.

And still 5 FOI’s outstanding, and getting later by the day.

2 more sent, specifically asking: How much?

And as Arnold Schwarzenegger once said… I’ll be back.